/GettyImages-1169053915-76068125fc394f9691db9edaf7c76baf.jpg)

There are unique situations in the broad sector, like offices, that have notable problems. Stick out the painĮven if buying more REIT shares isn't right for you right now, don't rush to sell well-run REITs. Now is not the right time to take on risky investment choices, but it also isn't the right time to hide your head in the sand. Just make sure to stick with financially strong and well-run REITs. While we can't know for certain if the REIT sector will stabilize, fall more, or recover, don't let fear of the unknown stop you from picking up a bargain if Wall Street has offered one. If REIT values start to recover, which seems likely at some point, you will end up with greater capital appreciation and more dividend income than you would have had if REITs hadn't declined.įor investors with spare cash, this could be the opportunity to add to existing positions at attractive prices, or to buy a REIT you have liked but that seemed too expensive. So you are increasing your position and lowering your average cost. By doing so, you are buying more shares at a lower price (and higher yield) with each dividend payment. The broad pullback in REIT shares, meanwhile, could actually have a hidden benefit for long-term investors that reinvest their dividends. And your initial capital is all you get back, there's no underlying growth.

When a CD matures or bond comes due, you have to hope you can find a new one at a comparable rate. Those investments will benefit the apartment landlord for years to come. Avalonbay is currently doing the same internally, with nearly $1 billion of planned development starts in 2023. As noted, Prologis just agreed to buy more properties, effectively growing its business and increasing its ability to support dividend growth. So even with the REIT pullback, there's a reason to favor REITs. With REITs, dividend increases can help defend your buying power. That means that inflation eats away at the purchasing power of your income stream.

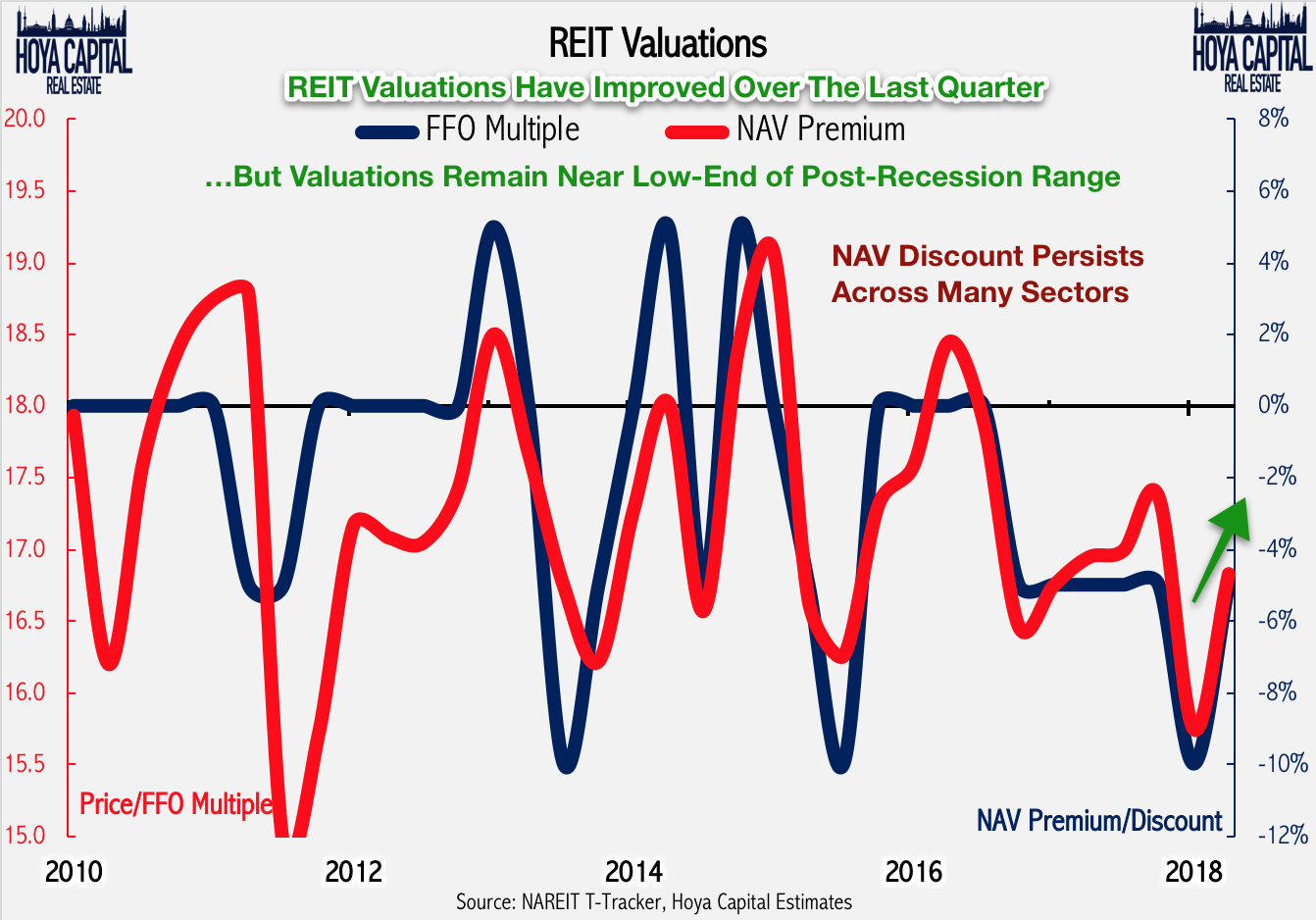

That's important when you compare a REIT to alternative income options like CDs or bonds, where the income you generate is basically static. Yes, the share prices of these REITs are lower, but their dividends remain intact, and are likely to head higher over time. You could add a lot of REITs to this "still the largest/industry-leading" list, including names like strip mall REIT Federal Realty, apartment landlord Avalonbay, and data center owner Digital Realty. Prologis is still an industry-leading industrial REIT with solid financials, and management just agreed to buy 14 million square feet of warehouse space from Blackstone. Realty Income (NYSE: O) is still the largest net-lease REIT, with a solid financial core, and management continues to invest in the business. The best-run landlords haven't suddenly lost their mojo. While REITs are lower as a group, investors shouldn't react too fearfully here. This isn't new either, though there is little that a REIT can do about what amounts to investor sentiment. The drop in REIT prices is, to some degree, increasing dividend yields to better compete. With rates notably higher, investors have other options, including safe, government-backed CDs. The other big problem with interest rates is that REITs are income vehicles that compete for investor attention with other income options. These are dislocations that can linger over a long period, but they aren't new or unusual, and financially strong REITs with good management teams can navigate them (for example, by pushing through higher rental rates). Many won't until there is financial distress, effectively forcing them to sell. There's also an impact on the translation environment, as sellers are generally slow to lower asking prices to accommodate higher borrowing costs. Directly, interest expenses can go up as the interest rates on variable-coupon debt increase and as fixed-rate debt rolls over. Rising interest rates impact REITs in a number of ways.

0 kommentar(er)

0 kommentar(er)